Tips to check your credit score...for free

Firstly what is your Credit Score

Everyone in the United Kingdom who has had credit, on the electoral roll will have a credit profile. Checking what is contained in your credit report is a must-do activity as this will dictate your ability to get credit in the future. Maintaining this as a mirror of your financial health is an important aspect to keep on top of.

By checking what your credit report says about you you can check it is an accurate reflection and if not then know where to go to fix the incorrect detail. It will even show if any fraudulent applications have been made in your name, all of which could prevent you from getting the credit you were looking for.

There are three main credit reference agencies in the UK who create a credit report on you. These are Callcredit, Equifax and Experian.

There's no such thing as a universal credit score. Each lender has its own system in place to decide whether or not to accept you as a customer, meaning you could be turned down by one, but successful with another.

To give you a better idea of how your application might be viewed by lenders, credit reference agencies produce their own version of your credit score.

The higher this number, the higher your chances of getting the best credit deals - but a good score from a credit reference agency is no guarantee that your application will be successful.

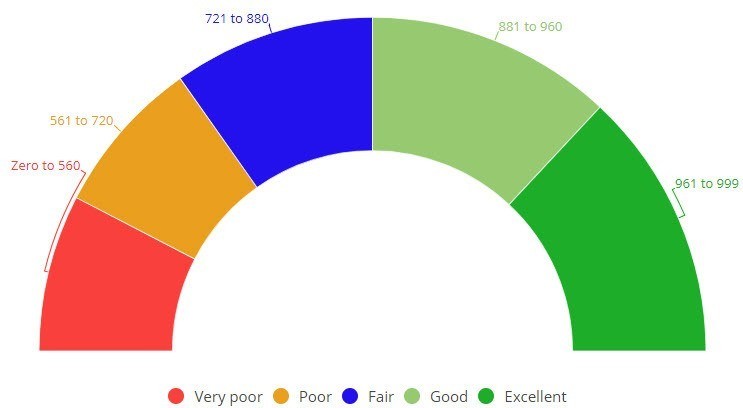

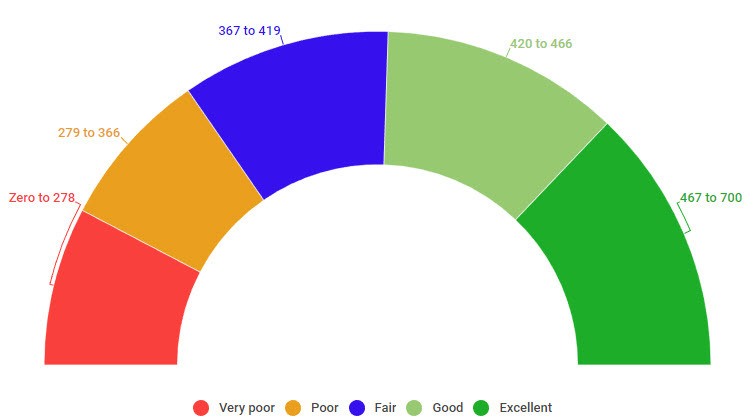

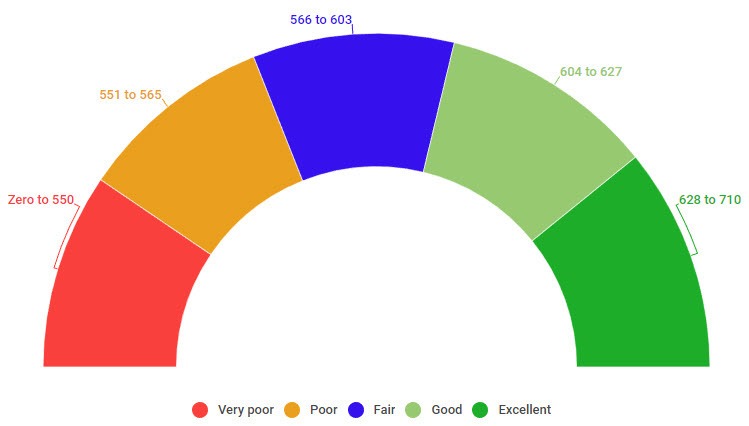

And confusingly, each credit reference agency uses a slightly different scale. For example, a score of less than 560 is 'very poor' with Experian, but 'excellent' with Equifax.

What affects my credit score?

Your score will ultimately be based on how responsibly you use your credit facilities.

For example, you lose 130 points with Experian if you fail to pay a bill on time but will gain 90 points if you use 30% or less of your credit card limit.

Like lenders, each credit reference agency has its own system for assessing your credit worthiness and will take into account different factors when calculating a score.

However, certain things will have a negative impact on your score regardless of the agency - for example, not being on the electoral roll, or making a late payment.

Bear in mind that the timing of entries in your report is more important than the type of activity.

Lenders are most interested in your current financial circumstances, so a missed payment from a few years ago is unlikely to scupper your chances of getting credit.

How do I check my credit score for free?

You have a legal right to access your credit report for £2 from a credit reference agency.

These statutory reports offer a snapshot of your credit history, and don’t include a credit score.

But the three main credit reference agencies all offer more comprehensive services for a monthly fee.

These provide unlimited access to your credit report, plus extra features, such as a score and alerts when major changes are made to your report.

However, it's now possible to access both your credit report and score without having to pay for a subscription.

Free credit scores from Experian

The largest credit reference agency offers new customers a free 30-day trial of its CreditExpert service, which gives you access to your credit report, score, and email alerts about any changes on your file.

After the trial ends, it will cost you £14.99 a month.

Another way to access your Experian credit score for free is to register for a free Experian account. Your free account lets you check your Experian Credit Score as many times as you like without affecting it.

Once you've signed up, your score will remain free to access, but unlike the paid-for CreditExpert service, you won't be able to see your credit report.

You can also see how likely you are to be accepted for the best rates on cards and loans and work out how much you can afford to borrow.

Unlike CreditExpert, you won't receive alerts about any changes to your report.

Free credit scores from Equifax/Clearscore

Like Experian, Equifax offers a free 30-day trial of its full credit monitoring service. It costs £9.95 a month after the free trial.

Alternatively, you can get your Equifax report and score free for life through Clearscore.

The company makes it money from commission on products you take out via its website.

Free credit scores from Callcredit/Noddle

You can access your Callcredit report and score for free via its Noddle service. This also advertises loans and cards you are likely to be accepted for.

Signing up to a free trial with CheckMyFile will give you access to all the information held on you by both CallCredit and Equifax for 30 days.

After this, you’ll have to pay £14.99 a month to keep the service.

What is a good credit score?

Each credit reference agency uses its own scoring system. The table below shows the scale each one uses and what a particular score means in terms of your credit worthiness.

Credit Reference Agency | Experian | Equifax | CallCredit/Noddle |

|---|---|---|---|

Maximum Score | 999 | 700 | 710 |

Score Grouping Very Poor | 0 - 560 | 0 - 278 | 0 - 550 |

Poor | 561 - 720 | 279 - 366 | 551 - 565 |

Fair | 721 - 880 | 367 - 419 | 566 - 603 |

Good | 881 - 960 | 420 - 466 | 604 - 627 |

Excellent | 961 - 999 | 467 - 700 | 628 - 710 |